[Webinar] How Much Capital Gains Tax Should I Pay?

ProACT Sam examines the liability for any successful investment.

Business property or savings - we all want them to grow and prosper.

When we sell business property crypto or investments we realise the gain we have made and the tax man wants his share of your gain.

When we die Inheritance tax becomes the tax charge on family.

This weeks webinar (view future webinars) looks how much expats could pay on capital gains tax around the world.

The next step in planning to save capital gains tax is to look at the competitive tax rates across the world and the see what fits with your family and business across border.

Remembering inheritance tax is the final capital gain applied to the wealth you create and earn.

This weeks webinar examines the options and ways to manage your capital gain liability so that you can plan to benefit your family and not the taxman.

Plan ahead

The first step to planning ahead to save tax to to know what the liabilities are, when they apply and how they arise?

Capital Gains tax is charged to asset sales including property, investments, crypto and bitcoin, and business assets including tangible and intangible assets.

Each tax jurisdiction charges capital gains in a different way.

If the capital gain ( as with income) is deemed to arise in any jurisdiction they will charge capital gains in the country of sale. A double taxation treaty may allow the capital gain to not be taxed in both jurisdictions, or not, and could mean an additional tax charge for higher rates of double taxation.

The the tax residence of the asset owner and the beneficiary of the sale is relevant consideration along with the tax treatment of the different tax residences.

Tax Residence

Any tax residence belongs to a legal entity that could be an individual, a partnership, a company including a Personal Service Company (PSO), or a Family Trust. The tax liability for any work or company depends whether that company is registered in any jurisdiction or holds a permanent establishment branch or business operation.

When Living and Working Abroad as a Nomad other options open up. By nomad we mean someone who had chosen to work remotely, not just from home but across borders. A nomad must be still tax resident somewhere. If a UK national is not tax resident anywhere then they should default to UK tax residency even if working around the world. In the past this may have been harder to track but in an interconnected world travel and location can be tracked more effectively whether through border crossings, travel tickets, card and banking transactions or our mobiles.

If a nomad taxes up a temporary residence for part of a year they can work remotely but pay tax in the country where they are tax residence or their employer has permanent establishment. This could protect against a capital gains liability but only if the expat nomad has the right tax residence.

UK expats could consider using split year for movement in or out of the UK. Again this can complicate the liability to any capital gain (or income) arising in the old or new country of tax residence. A UK expat could incur income and gains taxes on UK and foreign income, before or after the split year period. Protecting part year gains or income requires careful planning ahead.

Each tax jurisdiction has different rules on the treatment of taxes, for this article we consider Capital Gains for the UK and Cyprus

Capital Gains Tax Summary - UK

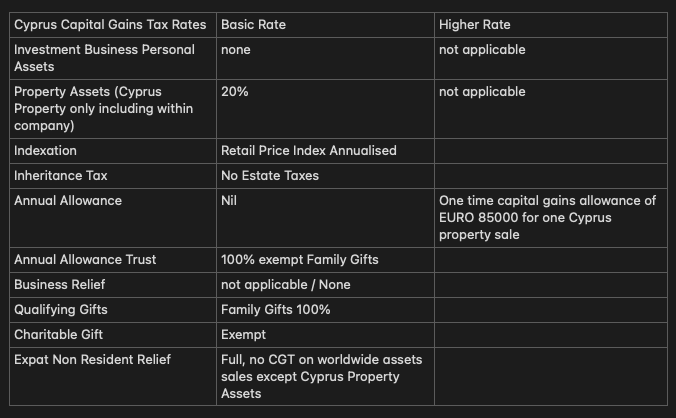

Capital Gains Tax Summary - Cyprus

UK Residential Property & Capital Gains Tax

A main UK residential property does get exemption from any capital gains tax. If more than one home exists this creates a potential liability that can be clarified by nominating the one residential property.

Any other UK residential property is taxed for the whole sum of capital gain from the date of purchase, less any allowance purchase and sale costs. There is no UK indexing of purchase price anymore although there was a rebasing so only UK property values from 5th April 2019 are used to calculate the gain. This means all UK residential property investors have a future of capital gains or inheritance tax liability to plan for in their UK property investment portfolio from 2019 until they die or sell.

Even if the residential property is held in a corporation capital gains tax can still apply. So all UK residential property is a taxable capital gain asset.

Commercial property is not taxed at the same rate and could be used by expats, depending upon the ownership, use and type of sale.

Gifts

Capital gains offer limited gift opportunities, but Inheritance tax can be generous when used in the right way.

Gifts between a UK spouse is exempt but this doesn’t extend to children or remoter relatives.

Inheritence tax allows for potentially exempt gifts that could negate a potential capital gains tax.

Meanwhile for Cyprus tax residents there is no capital gains or inheritance tax between families allowing a family and business asset to pass down the generations. This could apply to an expat individual, company or family trust.

Essentially the only capital gain charges to expats is any cyprus property assets, there is no main residence exemption, although here is a first property sale allowance of EURO 85,000 allowable for one lifetime sale of Cyprus property in addition to indexation.

Charitable donations always have the potential to attract tax charges on income and capital. Family and Business could consider creating a legacy through a a family charitable trust that retained control of assets within the family down the generations.

Action tax planning steps to save inheritance tax & capital gains

The final live webinar in our series will look at specific tax planning for expats to reduce the capital taxes on their family and business wealth.

You will discover ways to plan to mitigate and save capital gains tax on the wealth you create.

Long term tax planning for the legacy and retirement you plan is always the most cost effective way to secure family and business way in the same way you would save to pensions , use a property mortgage, invest in stocks and build a business. The wealth is accumulated over time, as is the tax liability and the tax saving opportunities.

Watch & listen to the webinar now and book a free review to see how much capital gains tax you could save.