From Celtic New Year to Current Tax Law: A Look at UK Financial and Historical Shifts

Subscribe to our newsletter for the latest expatriate news, views & analysis.

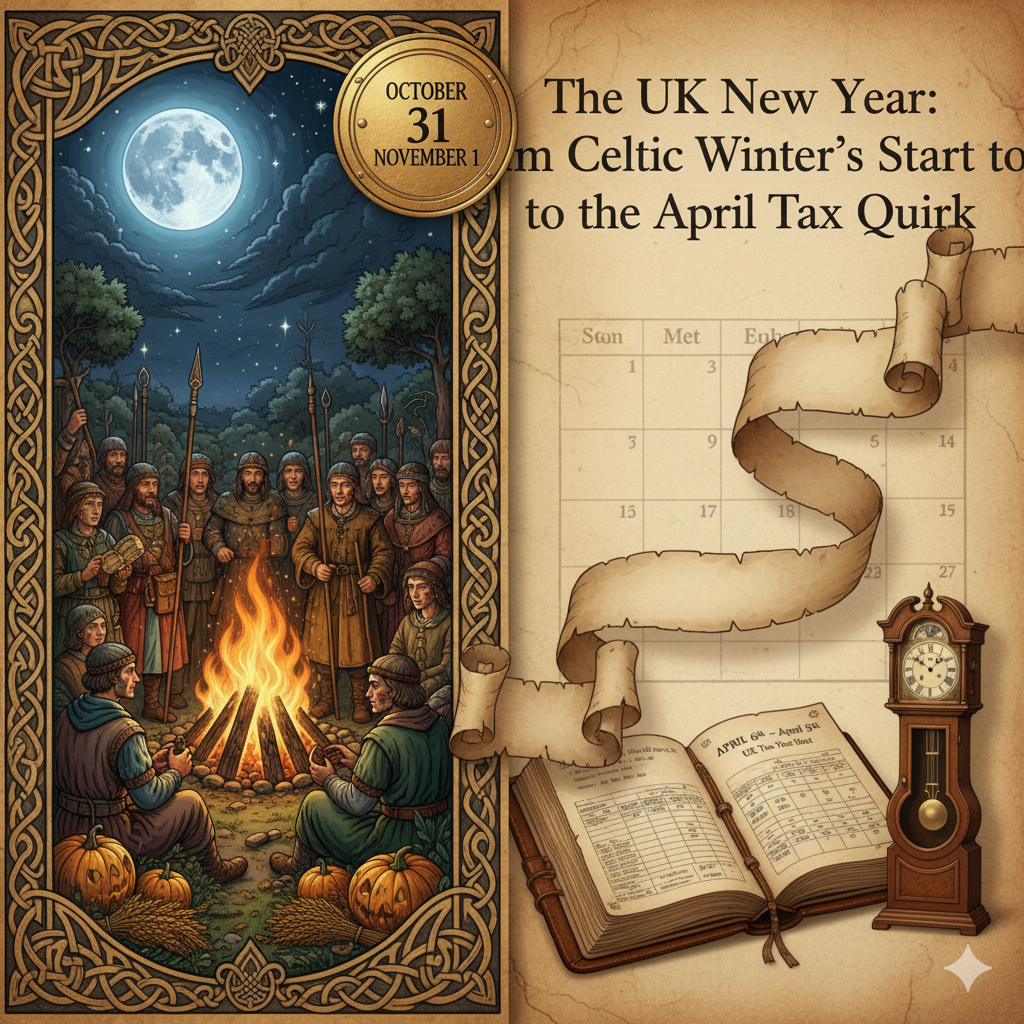

The tradition of the New Year in the UK is a fascinating mash-up of ancient pagan rites, Christian observance, and stubborn government bureaucracy. The roots of British winter celebrations go far deeper than January 1st.

Watch this weeks Living & Working Abroad Show

When Winter Began: The Celtic New Year

In pre-Roman Britain, during the time of the Celts, the year officially began on November 1st. This date marked the start of the winter season and the successful completion of the harvest.

The celebration held on October 31st was effectively New Year’s Eve, a festival now known as Halloween. This ancient custom of marking the transition from light to dark, and the end of the agricultural cycle, persisted for centuries.

The tradition was later overlaid by Christian holidays, becoming connected with All Saints' Day (November 1st) and, much later, the politically sensitive Bonfire Night (November 5th). Despite these historical overlays, the tradition of focusing on the start of winter and the "new year" in early November endured.

The Calendar Confusion and the Tax Year

A separate British tradition marked the new year at the Spring Equinox, specifically March 25th. This date historically served as the start of the English and British civil year.

This tradition led to the original start date of the UK fiscal year. However, in the 18th century (the 1700s), the UK was forced to adopt the more accurate Gregorian calendar, replacing Julius Caesar's flawed Julian calendar.

The transition required an 11-day adjustment to reconcile the dates with the rest of Europe. The British Treasury, famously reluctant to lose a single day of revenue, moved the start of the fiscal year forward by 11 days from March 25th to April 5th.

When the year 1800 was not a leap year under the new calendar (though it would have been under the old), the Treasury made one final adjustment, moving the date forward one more day.

This historical event is why the UK tax year begins on April 6th - a centuries-old legacy of an 11-day calendar correction.

Need help & guidance?

Contact us or book a free review with one of our expatriate experts for help & guidance living or working abroad.