Cyprus Tax 2023

Key dates, deadlines & information about Cyprus tax in 2023.

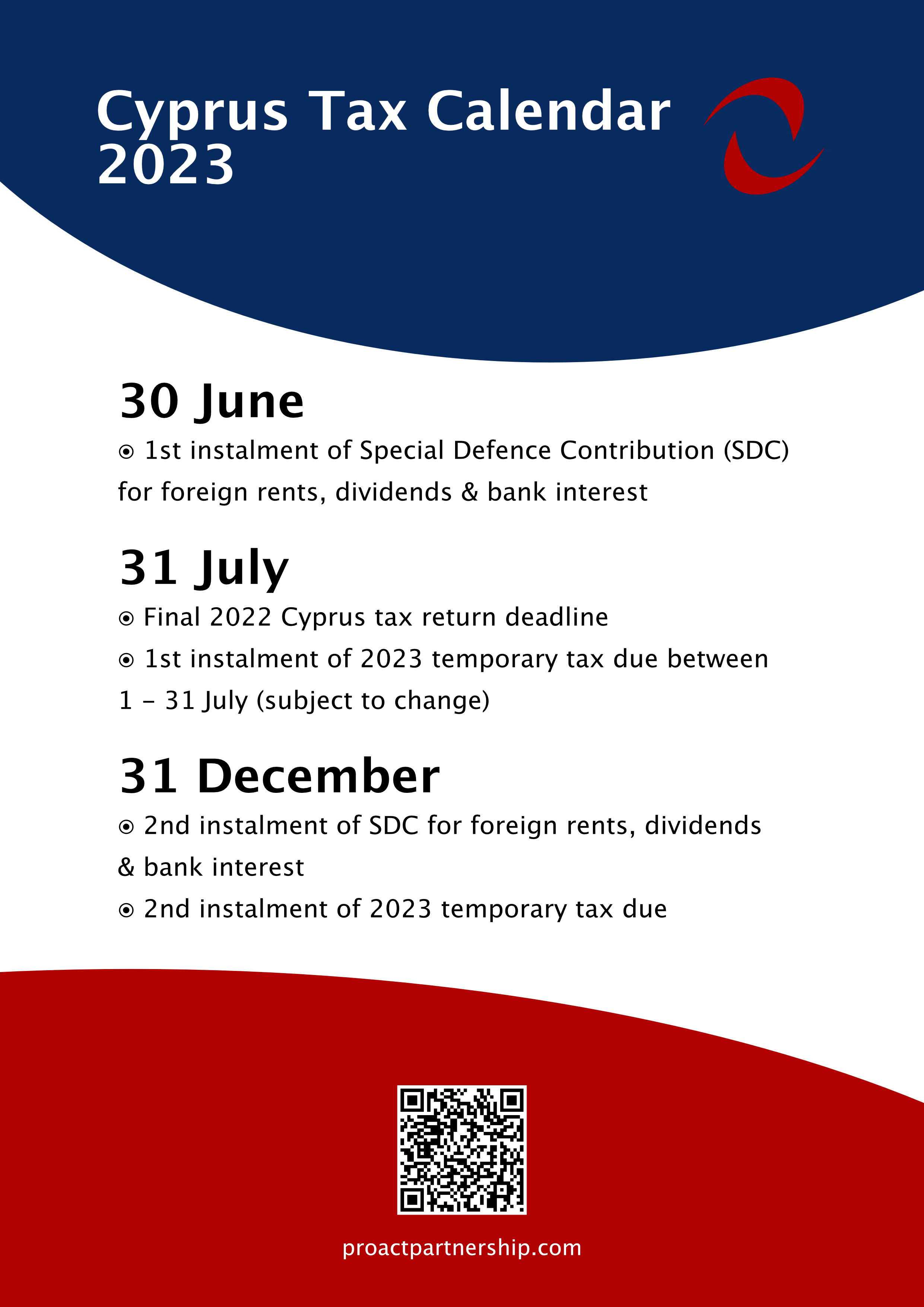

Key Dates

30 June 2023 - 1st instalment of Special Defence Contribution (SDC) for foreign rents, dividends & bank interest

31 July 2023 - 1st instalment of 2023 provisional tax due 31 July

No interest / penalty as long as it's paid by 31 August)

31 October (extended again) 2 October (extended) 31 July 2023 - Final 2022 Cyprus tax return deadline

31 December 2023 - 2nd instalment of SDC for foreign rents, dividends & bank interest

31 December 2023 - 2nd instalment of 2023 provisional tax due 31 December

No interest / penalty as long as it's paid by 31 January 2024)

Download 2023 Cyprus Tax Calendar

Get all the key dates in our handy download.

Cyprus Tax Rates 2023

Income tax

| Income (€EUR) | Tax Rate % |

|---|---|

| 0 - 19,500 | 0% |

| 19,501 - 28,000 | 20% |

| 28,001 - 36,300 | 25% |

| 36,301 - 60,000 | 30% |

| 60,000 + | 35% |

Special Foreign pensions tax

There is a special foreigns pension tax for overseas pensions with a flat rate 5% tax applied to the pension income over €3,420.

This tax is optional, you either choose to have your overseas pensions taxed at this rate or the normal income tax rate (above), whichever results in the lower tax bill.

| Income (€EUR) | Tax Rate % |

|---|---|

| 0 - 3,420 | 0% |

| 3421 + | 5% |

Should I pay the normal tax rate or special rate on my foreign pensions?

You can choose whether to pay the standard tax rate on your foreign pension(s), or the special tax rate. This is not an additional tax.

Your choice will depend on whichever option results in less tax.

Example 1

John has a UK state pension of €10,000 and a private UK pension of €5,000 per annum for a total income of €15,000.

John would chose to declare his pensions under the normal income tax rates as hit total income is below €19,500, of which all income is tax free.

Example 2

Jennifer has a UK state pension of €10,000 and a UK private pension of €20,000 for a total income of €30,000 per annum.

If she were to declare her income under the normal tax rate then her tax bill would be as follows:

Her total tax bill would be €2200.

If however she elected to have her foreign pensions taxed under the special foreign pensions tax rate of 5% her tax will would be as follows:

Jennifer would therefore elect to have her foreign pensions taxed under the special rate of 5%.

Get in touch

If you have any questions, you can contact us below. You can also book a free review or purchase one of our tax services.