Property Rental Tax Creep

Since financial exchange of information regulation was introduced 10 years ago great strides have been made to tackle criminal activities.

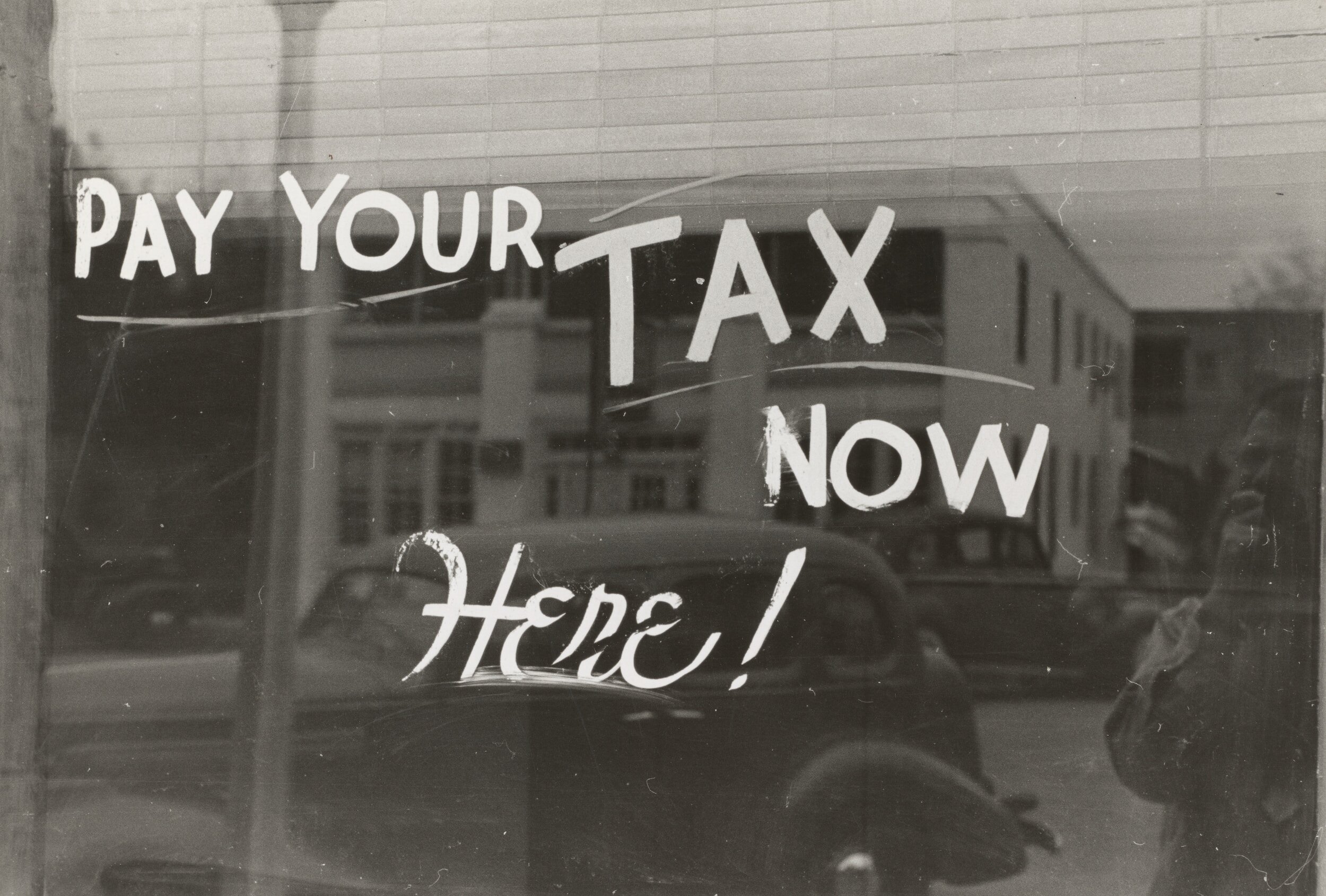

Anti money laundering (AML) is always at the centre and the essence of this is income not declared nor tax paid.

Cyprus Tax Return Portal Open, Deadline Extended

After technical issues the Cyprus tax return portal has opened, allowing you to submit your 2022 final tax returns. The deadline has been extended until 2 October.

Tax Independence Day: Maximising Expat Tax Savings 🗽🇺🇸

This week we celebrate the 4th of July Independent Day for the USA as a colony of the UK and as taxpayers to the UK.

2023 Cyprus Tax Payments & Return Due Now

Cyprus Self Assessed 2023 Income Tax returns and payments become due from June

Social insurance when living abroad

In this weeks live stream I take a deep dive into how social / national insurance works when you live abroad.

Tax efficiency for UK expats with split year treatment

Navigating the complexities of taxation can be challenging, especially for UK expats. For individuals leaving the UK or returning after a period abroad, a crucial concept that can impact their tax liabilities is the Split-Year Treatment (SYT). SYT is a concession under the Statutory Residence Test (SRT) introduced in 2013, which allows UK expats to split a tax year into a UK part and an overseas part, limiting their tax liabilities on overseas income.

8 countries with tax incentives for expatriates

There's more to gain from living abroad than just immersing yourself in an array of beautiful cultures and picturesque landscapes. Did you know that it can also bring significant tax benefits? 💰💼📈