2023 Cyprus tax return deadline extended

2023 Cyprus tax return deadline extended until 31 October 2024.

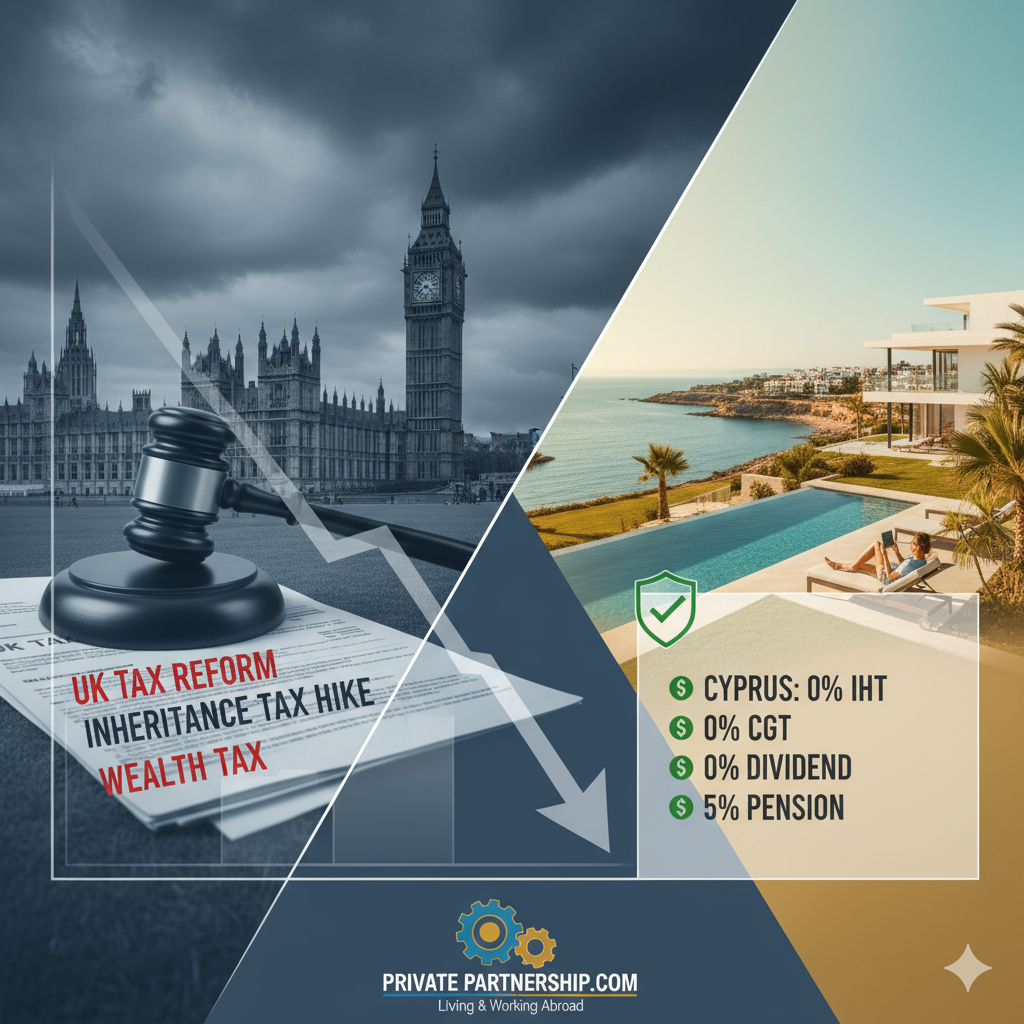

Tax Creeps - Changing World for UK Expats

For the past two decades, we have witnessed an unrelenting rise in taxes across all sectors. Governments have consistently found reasons and excuses to justify these increases, burdening citizens with a growing financial load.