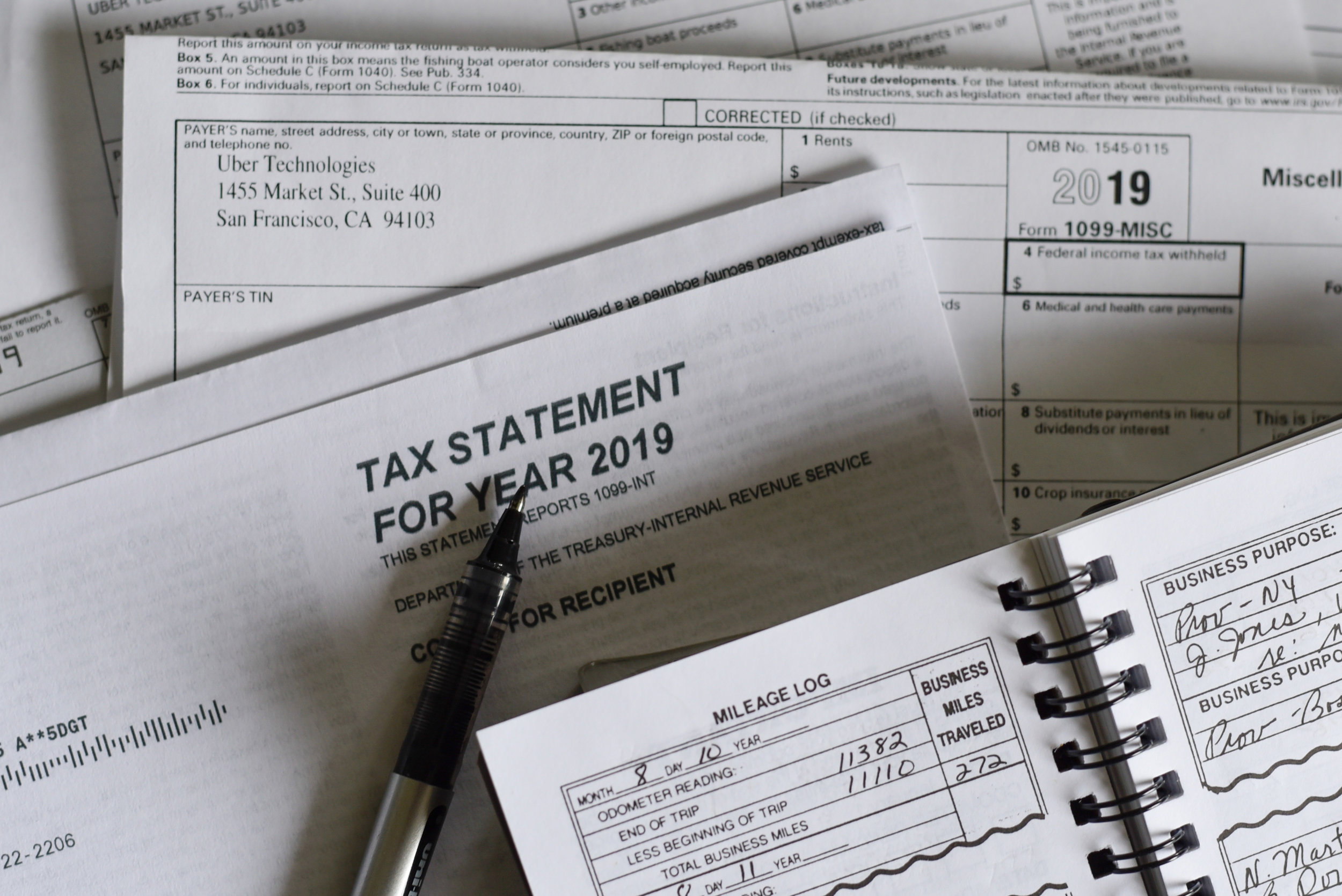

Non resident capital gains tax for UK Expats

ProACT Sam explains how non resident Capital Gains Tax works for UK Expats. Specifically, we look at how income or capital gains liabilities arise in another country for Expats who are non resident to the UK, are Living and Working Abroad and looking to make tax efficiencies cross-borders.

3 things Expats in Cyprus need to consider now

ProACT Sam considers 3 things that expats in Cyprus need to consider now.

Coronavirus and Brexit: Latest for Expats

ProACT Sam provides an update on the latest situation with Coronavirus and Brexit, considering areas of importance for Expat families and those with businesses abroad.

Exit from lockdown: What next for Expats?

As more countries throughout the world begin their exit from lockdown, what can Expats expect now?

ProACT Sam looks forward to Living with Corona.

Tax Residency for Expats during lockdown

If you spend more than 183 days in any country you become tax resident. This could pose problems with tax residency for Expats during lockdown. Some countries still allow flights and shipping.

Balancing economy and the value of life

ProACT Sam considers the ‘quality of life’ issues relating to the big political decisions of the day, together with individual decisions we will need to make both as Expats and as consumers.

The Business of Survival for Expat Businesses & Contractors

Part 12 in the WWC - Coping with Coronavirus series

How the Expat Business World Can Respond to Coronavirus

Part 11 in the WWC - Coping with Coronavirus series

What Expats Need to Do to Take Advantage of a World of Opportunity

Part 10 in the WWC - Coping with Coronavirus series

What are the questions business owners should ask during the Coronavirus crisis?

Part 9 in the WWC - Coping with Coronavirus series

How is Work and Business Abroad Impacted by Coronavirus?

Part 8 in the WWC - Coping with Coronavirus series