Tax Obligations for Remote Workers in Cyprus with UK Employers

In an increasingly connected world, the opportunity to work remotely from picturesque locations like Cyprus, while being employed by a company based in the UK or elsewhere in Europe, is an attractive proposition for many. However, this dream scenario comes with its own set of tax and social insurance complexities that remote workers need to navigate. Here’s what you need to know if you find yourself in this situation.

The Cyprus Tax Haven: How Remote Working Contractors Can Enjoy 0% Tax

In today’s digital economy, remote working has become the norm for many contractors, and Cyprus is emerging as a haven for those looking to optimise their tax situation. The Cypriot tax system presents an opportunity for remote contractors to benefit from 0% tax, whether they operate with or without a Personal Service Company (PSC).

Understanding Cyprus's "Tax For All" System

Cyprus has introduced a groundbreaking "Tax For All" system. This comprehensive tax reform aims to simplify the tax filing process, enhance transparency, and ensure a more equitable tax collection. As Cyprus positions itself as a leading destination for expatriates and businesses, understanding the implications of this new system for tax residents is crucial.

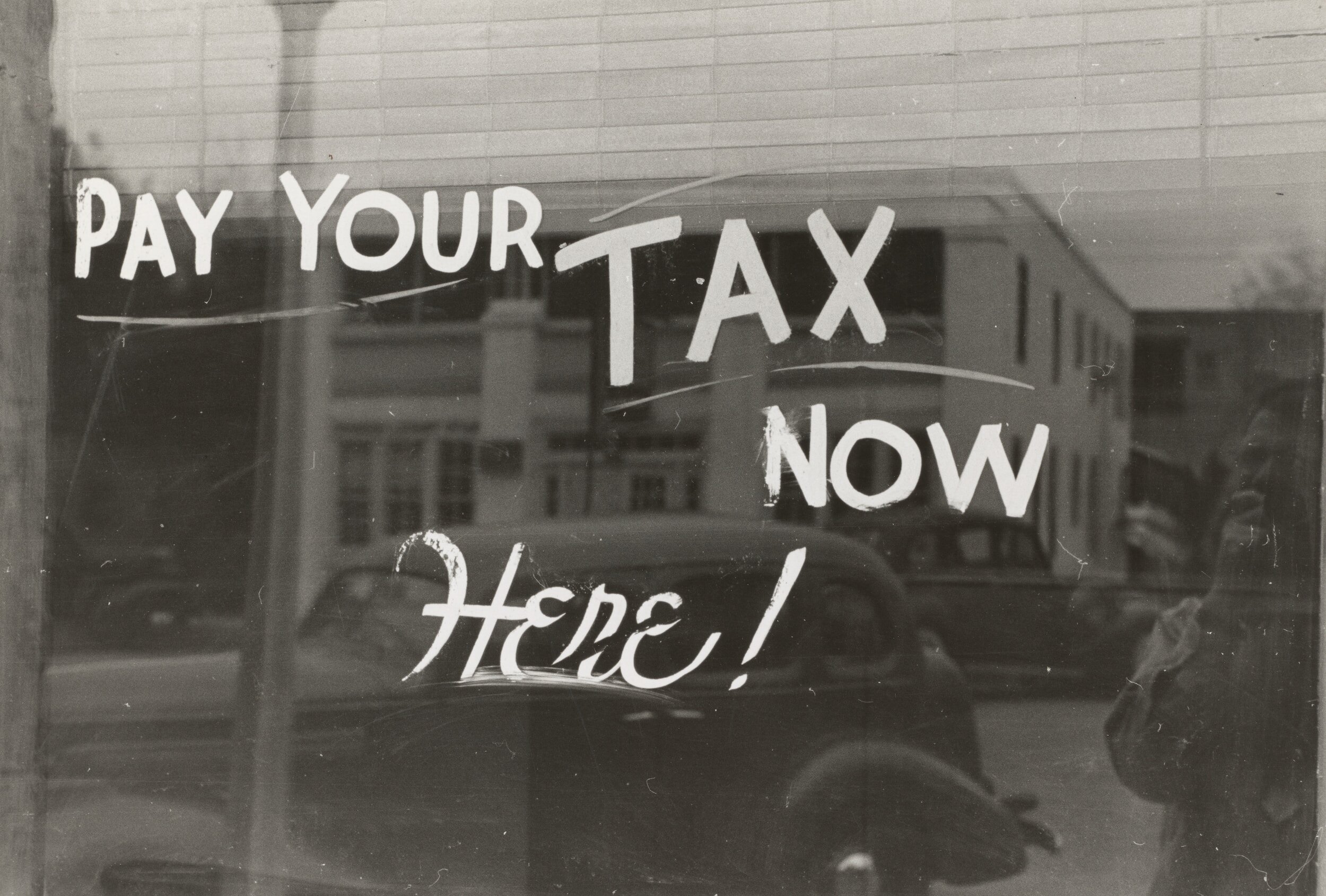

Cyprus Tax Return Portal Open, Deadline Extended

After technical issues the Cyprus tax return portal has opened, allowing you to submit your 2022 final tax returns. The deadline has been extended until 2 October.

2023 Cyprus Tax Payments & Return Due Now

Cyprus Self Assessed 2023 Income Tax returns and payments become due from June