'No Land is an Island' - Look Forward to EU Brexit for Expats.

Europe is to lose a piece of land with the UK to be washed away into a big wide global trade world.

The EU Brexit for Expats journey has been filled with many stories of doom and loss for one and all, at times the negotiations have looked washed up, bettered only by the potential out break of a world war 2 weeks ago.

Now we have spring, with summer around the corner and everything is looking rosy on the continent, on the maine of Europe.

Brexit Timetable Laid Out

Brexit reached a watershed on 24th March 2018 as a draft treaty was approved by the EU council of ministers.

I thought we would set out the timetable for EU Brexit as a timeline.

Introducing the Podcast Living & Working Abroad For Expat Family and Business

Introducing the Living and Working Abroad podcast.

We're very excited to introduce to you the Living & Working Abroad weekly podcast brought to you by ProACT Partnership Expatriate Advice.

Brexit Timetable Laid Out

Brexit reached a watershed on 24th March 2018 as a draft treaty was approved by the EU council of ministers.

I thought we would set out the timetable for EU Brexit as a timeline.

4 Actions & Deadlines for Online Expat Tax Returns 2018

Auto Matic - Auto Exchange - Auto Mate

This is the year of online for Expats Tax Returns.

How are you with online emails, facebook and social media? Are you comfortable with online bank accounts ? Are you an email wizard or do you still send post? Or have you only ever received junk mail and financial statements by post for the last 3 years?

2018 Online Tax Returns for Expats

This year the time has come to embrace the future.

Register to submit online tax returns, embrace online accounting for business, and pay tax online.

ProACT are launching a new Online Tax Return Service

No Spring Budget for UK

The UK had a political financial statement on 13/3/18 but with no changes or announcements on fiscal matters.

This Spring statement is an update only.

A November budget to implement tax changes following April.

That’s the new UK Way for Budget statements

November’s Budget confirmed the UK tax and financial position in the year to Brexit

ProACT Sam 14/3/18

ProACT Cyprus Tax Return Service 2018

ProACT Cyprus Tax Return Service 2018 - deadlines, due dates and online service

Contact Us to Book a Meeting to Prepare and Complete your Cyprus Tax Returns

Full Full year tax returns are submitted on line from 2017.

ProACT can assist with Tax registration and online returns and payments.

Expat Contractor - Business Bank Account for a Service Company

ProACT Sam offers 5 questions to consider for a service business bank account.

If you operate as an Expat contractor overseas using a UK or other offshore company as a service company there are a number of considerations regarding a bank account.

ProACT Partnership Tax Saving Expat Experts offer Free Reviews and Bank Account Opening Service for professionals, contractors, business and the retired living and working abroad or investing and contracting overseas

JOIN US for Live Webinar Thursday 25/1/2018 5PM Cyprus 3PM UK

What Are the Residency Options with EU Brexit for Expats in the UK and Brits in the EU and Cyprus?

Review this Webinar you will discover that the world continues after Brexit and Living and Working Abroad is still possible but with some different rules.

ProACT Sam Orgill discusses the Residency Status of Expats in view of EU Brexit and how Working, Retiring, Investing Abroad will work for you in the coming years.

You will learn 5 Residency Options for Expats to follow Living and Working Abroad

Common Reporting Standards - How it Works for Expats Living and Working Abroad

How it Works for Expats Living and Working Abroad

ProACT Sam highlights the changes in exchange of informatio and what Expats should consider about the way they report tax income and capital.

Exchange of financial information has been around since 2005 when any savings or investment income was required to be reported by the bank/investment fund to their local tax authorities.

From the start of 2016 a new level of exchange of information was introduced. Called the Common Reporting Standard (CRS) by 2018 102 countries (including every one of 28 EU countries) have committed to CRS exchange of information.

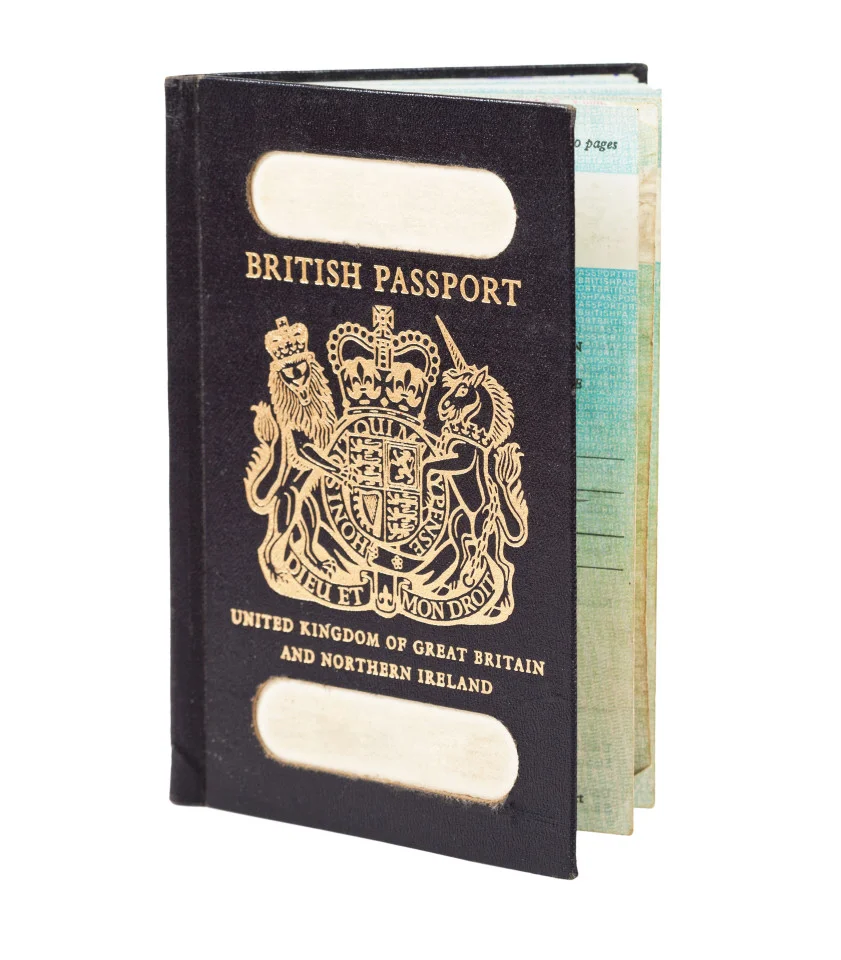

UK Passports Return Post Brexit

UK Passports Return Post Brexit

The UK will regain some of its unique traditions from October 2019 with a return of the traditional Navy and Gold UK passport.

Step by step there will develop differences between the UK and EU as they diverge.

![[Podcast] MayDay in Brexit Game of Thrones](https://images.squarespace-cdn.com/content/v1/5395bf36e4b08d48e3de15c9/1525984931462-LLL7P3TM33K2VA0YFWWX/IMG_0322.PNG)