How is a UK Expat Taxed on Income When Returning to the UK Mid Year

How is a UK Expat Taxed on Income When Returning to the UK Mid Year

How can I open a business bank account in Cyprus?

How can I open a business bank account in Cyprus?

How do I start a business abroad?

ProACT Sam looks at how you can start a business abroad?

How do you protect your business abroad?

How do you protect your business identity abroad?

Brexit Timetable Laid Out

Brexit reached a watershed on 24th March 2018 as a draft treaty was approved by the EU council of ministers.

I thought we would set out the timetable for EU Brexit as a timeline.

ProACT Cyprus Tax Return Service 2018

ProACT Cyprus Tax Return Service 2018 - deadlines, due dates and online service

Contact Us to Book a Meeting to Prepare and Complete your Cyprus Tax Returns

Full Full year tax returns are submitted on line from 2017.

ProACT can assist with Tax registration and online returns and payments.

Expat Contractor - Business Bank Account for a Service Company

ProACT Sam offers 5 questions to consider for a service business bank account.

If you operate as an Expat contractor overseas using a UK or other offshore company as a service company there are a number of considerations regarding a bank account.

ProACT Partnership Tax Saving Expat Experts offer Free Reviews and Bank Account Opening Service for professionals, contractors, business and the retired living and working abroad or investing and contracting overseas

JOIN US for Live Webinar Thursday 25/1/2018 5PM Cyprus 3PM UK

What Are the Residency Options with EU Brexit for Expats in the UK and Brits in the EU and Cyprus?

Review this Webinar you will discover that the world continues after Brexit and Living and Working Abroad is still possible but with some different rules.

ProACT Sam Orgill discusses the Residency Status of Expats in view of EU Brexit and how Working, Retiring, Investing Abroad will work for you in the coming years.

You will learn 5 Residency Options for Expats to follow Living and Working Abroad

Common Reporting Standards - How it Works for Expats Living and Working Abroad

How it Works for Expats Living and Working Abroad

ProACT Sam highlights the changes in exchange of informatio and what Expats should consider about the way they report tax income and capital.

Exchange of financial information has been around since 2005 when any savings or investment income was required to be reported by the bank/investment fund to their local tax authorities.

From the start of 2016 a new level of exchange of information was introduced. Called the Common Reporting Standard (CRS) by 2018 102 countries (including every one of 28 EU countries) have committed to CRS exchange of information.

4 Steps to RAIS Your Game and Overcome Challenges

Embrace the New Year with resolve and resolutions you keep.

Don't stay where you are , consider a life Living and Working Abroad.

Recognise

Recognise the Challenge in front of you, say hello

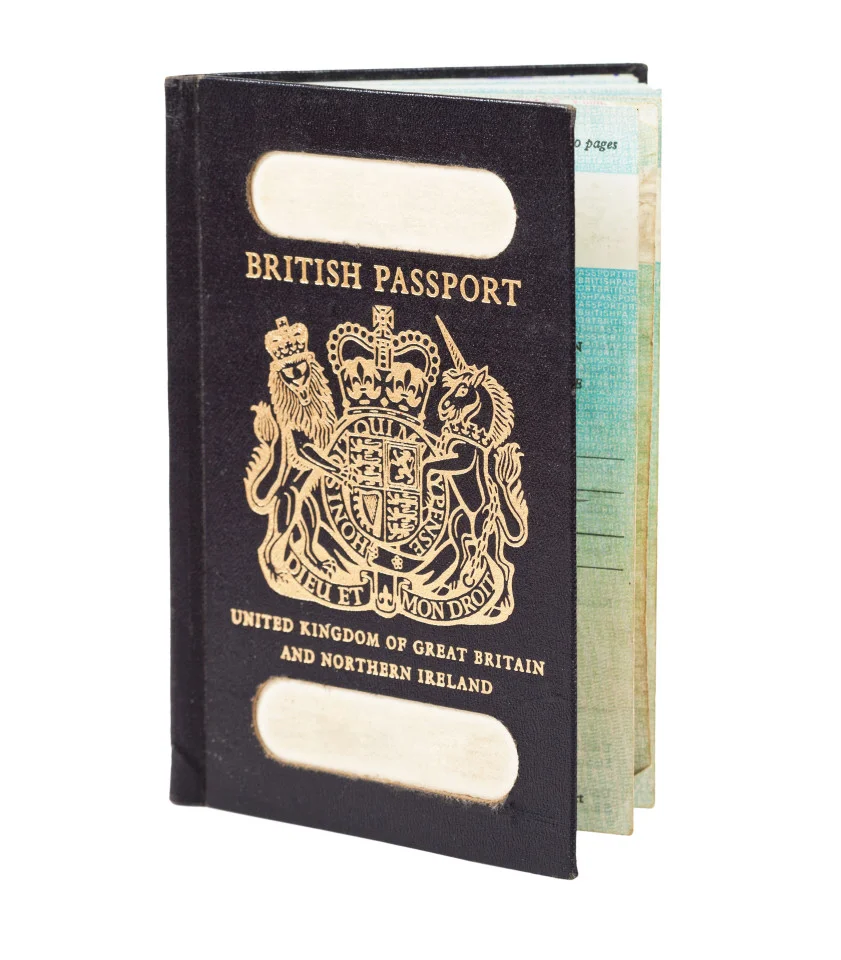

UK Passports Return Post Brexit

UK Passports Return Post Brexit

The UK will regain some of its unique traditions from October 2019 with a return of the traditional Navy and Gold UK passport.

Step by step there will develop differences between the UK and EU as they diverge.