Italy's Expat Scheme Offers Up To A 90% Reduction In Tax!

Italy have implemented a 5 year tax reduction scheme of 70% for expats moving to Italy with up to 90% in some regions.

[Webinar] Capital Tax Liability Cross Border for Expats

ProACT Sam went live in May’s monthly Wednesday Webinar to highlight how expats have to account for capital taxes separately to income.

Inheritance Tax: What Could Go Wrong When You Move Abroad?

The UK doesn't forget about you just because you live in Cyprus or Portugal. Getting inheritance tax right is complex and takes long term planning. We have been helping expat for almost 20 years to ensure that their family receives their inheritance and not the taxman.

Why is inheritance tax charged to UK expats who have moved abroad?

When you move abroad you can become a tax resident in your new country which means you’re able to pay tax on your business income, pensions, interest & property rental income at, often lower, local rates.

So why do UK expats still get charged inheritance tax in the UK even though they are tax resident abroad?

You are going to die. So protect your family.

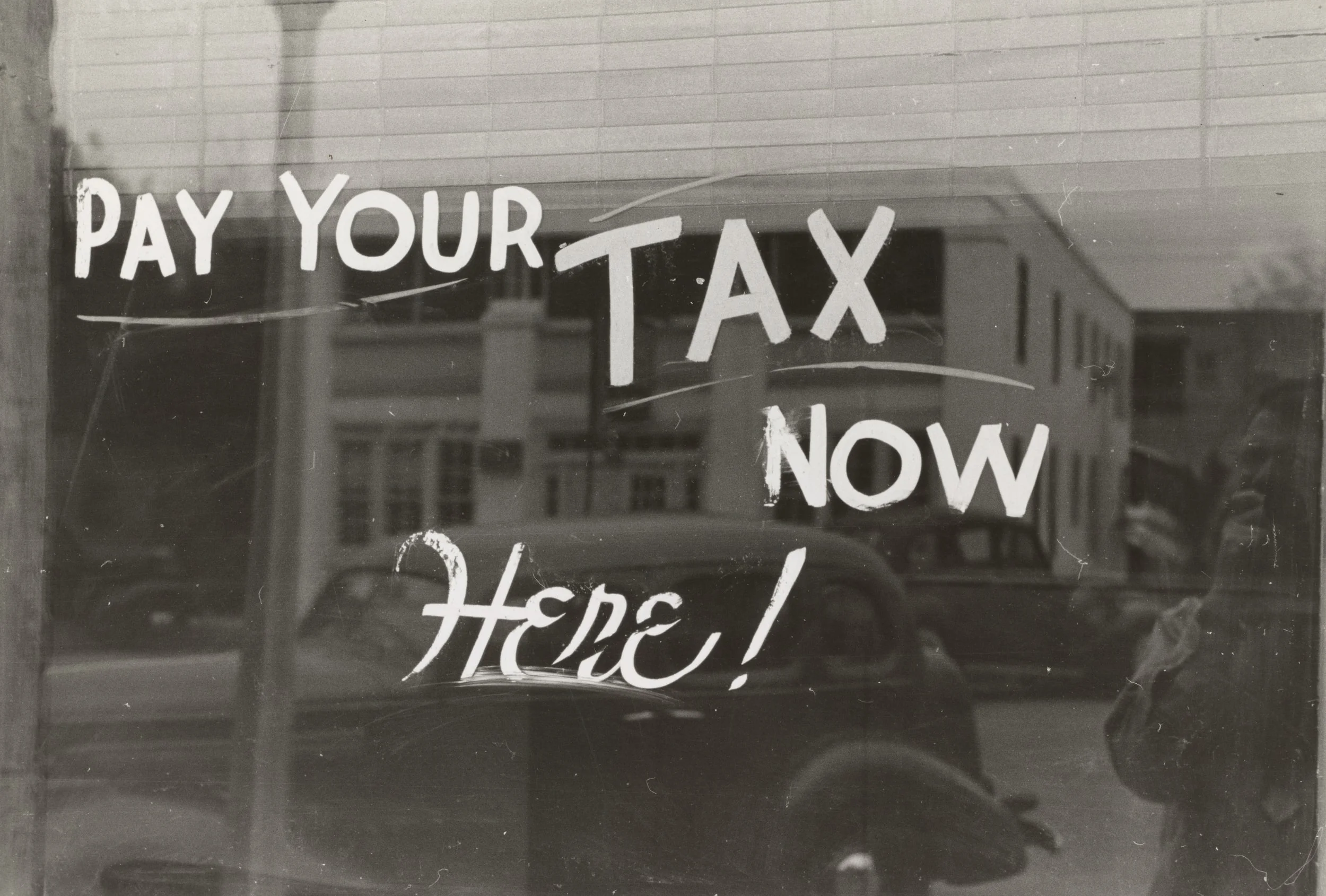

There are two things in life that are certain.

Death and taxes.

We can't help you with the inconvenience of death. But we can help you pay 0% inheritance tax with long term planning.

Do You Want To Pay 0% Inheritance Tax?

Do you want to pay 50% inheritance tax?

Or do you want to pay 20% by giving it away on your death bed?

Or do you want to pay 0%?

So that your inheritance goes to your children, and not the tax man.

The Worst Thing We Ever See In Our Office

The worst thing we ever see at ProACT Partnership’s Tax Planning Business are families trying to make arrangements to avoid Inheritance Tax at 40% or more on their estate on death.

[Webinar] Inheritance Tax for Expats

In this months Wednesday Webinar (view future webinars) we looked at inheritance tax for expats and how with long term planning you can minimise your tax when you die.

What Does IR35 Mean for Self Employed Expat Contractors?

The UK have introduced new tax rules for contractors working for UK based business. Find out what expats can do about IR35.

Where Should You Pay Tax After Lockdown?

With tax returns becoming due in the UK, Cyprus & other expat locations we look at where you should be paying tax after a lockdown that saw many expats stuck in 1 location with potentially higher tax liabilities.

When Does HMRC Lose Interest in your Overseas Income?

ProACT Sam discusses the challenges for expats maintaining a bank service across borders.

Cyprus Tax Return Deadline Extended, Again

The 2019 Cyprus online tax return deadline has been extended again to 15th December 2020.

![[Webinar] Capital Tax Liability Cross Border for Expats ](https://images.squarespace-cdn.com/content/v1/5395bf36e4b08d48e3de15c9/1621931498999-POBOZE54WN57VDBOJ1WK/yt.png)

![[Webinar] Inheritance Tax for Expats](https://images.squarespace-cdn.com/content/v1/5395bf36e4b08d48e3de15c9/1619679013354-ABTXE75I9Q6ECL2QLKW8/Apple.png)